Level’s Student Loan Assistance Plan helps with returning loan repayments

As part of the all-hands-on-deck effort to protect people from Covid’s effect on the economy, in 2020 the Department of Education granted borrowers the ability to defer student loan repayments. While it lasted, about 35 million Americans – a significant percentage of working adults – were able to take a breath and pause installments and interest accruals.

After the quiet, comes the storm. As of October 1, 2023, payments have resumed. For those employees who became accustomed to making ends meet without that monthly bill, the return of payments will be a painful squeeze on their budget. Approximately one in five borrowers could struggle to pay back their student loans as scheduled payments resume.1

This is compounding already high levels of anxiety and economic uncertainty, and could force employees to choose between investing in their futures, and servicing their shorter-term needs.

Employers are reacting by looking to bolster their Learning and Development (L&D) benefits and include student loan repayment programs:

- While only 17% of employers currently offer a student loan repayment program2, that figure is expected to nearly double in the future3

- After all, 94% of employees say they would stay at a company longer if it invested in their learning and development4

Helping their employees is not the question. What employers are asking is this: how do we do this wisely? How can we offer assistance efficiently and fairly? How do we introduce this so we’re not adding another vendor into an overcrowded employee experience? How do we make this simple to administer, if we already have a Learning and Development (L&D) program in place? And if we don’t have an L&D program in place, how can we offer one that best suits the diverse needs of all our employees?

Level offers student loan reimbursement as a stand-alone product or with Education Assistance, seamlessly in the same product

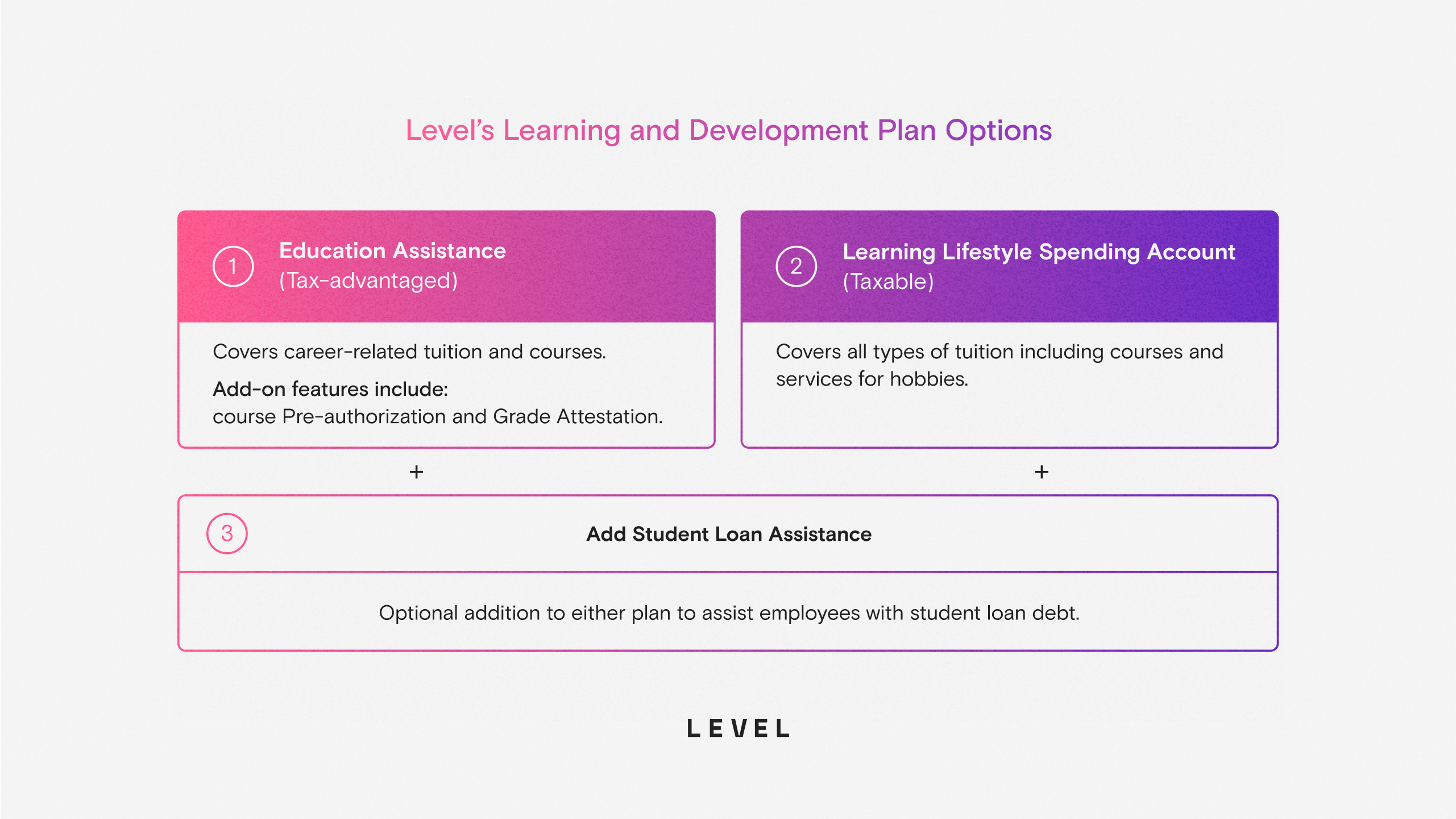

Employers can choose from two different L&D plans, each with the option to also cover Student Loan Assistance, or they can offer Student Loan Assistance as a standalone product. To access their funds, employees pay with their Level Card, removing the burden of upfront costs or the need for reimbursement.

Note: Due to lender restrictions, employees are required to file for reimbursement for Student Loan Assistance in the Level App.

When offering Student Loan Assistance in combination with Level’s Education Assistance benefit, fairness is baked into the product. Level’s offering stands out from most educational assistance programs in that it provides first-dollar coverage for job-related upskilling. Rather than having to pay thousands of dollars in expenses upfront then waiting months for reimbursement, the app gives access to education to those employees who may not otherwise have the means.

Administer Student Loan Assistance as a tax-advantaged benefit or a non-tax-advantaged Lifestyle Spending Account (LSA)

Option #1: Add Student Loan Assistance to Level’s tax-advantaged Education Assistance benefit

Combining Student Loan Assistance with Level’s tax-advantaged Education Assistance benefit gives employers flexibility in how to configure and control Pre-authorization and Grade Attestation for employee course approval and satisfactory completion of courses. Using Level’s Visa card and app, the benefit covers job-related and professional development courses, books, tuition, and processing fees, with no out-of-pocket costs and no waiting for reimbursement.

When added to the Education Assistance benefit, Student Loan Assistance adopts its capped, tax-advantaged status, meaning employees can spend up to $5,250 in qualifying educational benefits related to loan repayment and/or upskilling that are tax-free to employees. This unique plan design allows for the greatest number of employees to take advantage of the available funds in their pursuit of continued education.

Option #2: Add Student Loan Assistance to Level’s Learning Lifestyle Spending Account (LSA) benefit

Level’s Learning LSA plan can cover student loan reimbursement as a taxable benefit with no benefit cap limit.

The Learning LSA expands upon the Education Assistance benefit in that it can cover any kind of learning-related expense. It maximizes flexibility and choice, covering not only job-related courses and classes, but also other hobby-related and education-related costs, such as career coaches, conferences, tutoring, books, and even subscriptions. With this plan, employees also use the Level Card and app to eliminate upfront, out-of-pocket costs and the need to wait for reimbursement for such learning-related expenses.

Level meets you where you are

By offering Student Loan Assistance on its own, or combined with Education Assistance as a tax-advantaged benefit or taxable Learning LSA, Level can meet the needs of your team flexibly.

With a comprehensive L&D benefit that includes Student Loan Assistance, a company can acknowledge—that is, invest in—another important employee population: those in need of a simple, effective solution to help pay off their student loans.

At the same time, those without loans who wish to use Level’s L&D benefits to access other learning opportunities—be it to further their education through a formal qualification, or expand their skills or knowledge by attending a conference or hiring a tutor—are still free to do so.

It’s not either/or, it’s both at once—supporting anyone with an education need, by choosing to create the education/learning and development plan that works best for your employees.

Education starts with understanding our customers. If you’re interested in learning more, please reach out here.

1. Consumer Financial Protection Bureau, “Office of Research blog: Update on student loan borrowers as payment suspension set to expire” (June 7, 2023). See www.consumerfinance.gov/about-us/blog/office-of-research-blog-update-on-student-loan-borrowers-as-payment-suspension-set-to-expire/.

2. Society of Human Resource Management, citing the Employee Benefit Research Institute (June 1, 2022). See www.shrm.org/hr-today/news/hr-magazine/summer2022/pages/is-it-fair-for-employers-to-offer-student-loan-repayment-as-a-benefit.aspx.

3. Employee Benefit Research Institute, “EBRI Employer Financial Wellbeing Survey”. See www.ebri.org/crawler/view/how-employers-are-tackling-student-loan-debt-evidence-from-the-ebri-employer-financial-wellbeing-survey.

4. LinkedIn Learning, “2020 Workplace Learning Report”. Available at https://learning.linkedin.com/content/dam/me/learning/resources/pdfs/LinkedIn-Learning-2020-Workplace-Learning-Report.pdf.