One app, one card, one platform: Level introduces Pre-Tax Spending Accounts to help employees save more

In 2024, Level will add Pre-Tax Spending Accounts (FSAs, Commuter, HSA) with COBRA, to our existing suite of Lifestyle Spending Accounts (LSAs), Health Reimbursement Accounts (HRAs), Mental Health, Dental, Vision, and more — all on one intelligent platform.

A more rewarding benefits experience

Level has focused the last few years on refining our platform to supercharge engagement across benefits.

Now we’re bringing this expertise to Pre-tax Spending Accounts. We’re overhauling the traditional experience with modern tools designed to help everyone maximize their savings, because when employees get to keep more of their earnings, employers pay less in payroll taxes – making Level Pre-Tax a win-win for everyone.

Rebuilding trust with clarity

Administering an array of benefits for employees is complex, especially in the face of unprecedented rising healthcare costs. Employers are looking for a smarter approach to savings while their employees are looking for practical ways to meet these financially challenging times.

But while pre-tax benefits – like FSAs, commuter benefits, HSAs, and HRAs – play a key role in a competitive benefits package, a dated experience makes them difficult to understand. This confusion has led to frustration and inevitable skepticism and mistrust, with many employees opting not to enroll or engage due to these all too familiar pain points:

- Education gaps: FSAs and HSAs are complex, requiring employees to become quasi-experts in benefits to use them effectively. This places a heavy burden on HR teams to educate and communicate with their people and, despite the potential for savings, results in low enrollment – 37% of employees enroll in FSAs, and only 20% of those enrolled actually use pre-tax benefits1.

- Payment Complexity: Employees often find it challenging to use tax-advantaged spending accounts due to the complicated payment processes involved, especially with multiple vendors each having their own procedures, cards, and apps.

- Administrative overhead: Managing these spending accounts becomes increasingly complex for HR when multiple vendors are involved, each with unique requirements and systems. The more vendors there are, the more HR professionals need to compile multiple sources of data to get a complete understanding of utilization and ROI.

These pain points result in the forfeit of significant savings for employees (on average, employees end up losing $331 every year1), which we believe is too great of a cost.

But there is a smarter way: introducing the much-needed upgrade to pre-tax benefits.

Announcing Level Pre-Tax Spending Accounts

Level’s upgraded experience is designed to address challenges by offering employees continuous education and support, all through a single intelligent app and card that streamlines administration for employers.

Continuous education and support

- Clear communication: All employee communications are written for people, not benefits experts, while contextual messaging addresses the most common moments of confusion before they happen.

- Interactive enrollment: Level offers interactive tools to guide employees in selecting the most suitable benefits and contributions to meet their needs.

- Intuitive experience: The Level App streamlines details on plan coverage, while our smart search function helps clarify item coverage in the moment. Timely notifications also combine with in-app support to ensure members are supported from enrollment to purchase and beyond.

Intelligent platform

- One card, one platform: Level consolidates all pre-tax spending accounts – alongside Lifestyle Spending Accounts (LSAs), Mental Health, Learning and Development, Wellness, and more – into a seamless user experience, powered by one card.

- Proprietary technology: Our multi-purse ranking technology automatically debits funds from the most advantageous account, minimizing forfeitures and maximizing savings.

- Real-time updates: The app enables users to track, monitor, and manage account balances, usage, and activity so employees can stay on top of their money effortlessly.

Simplified employer administration

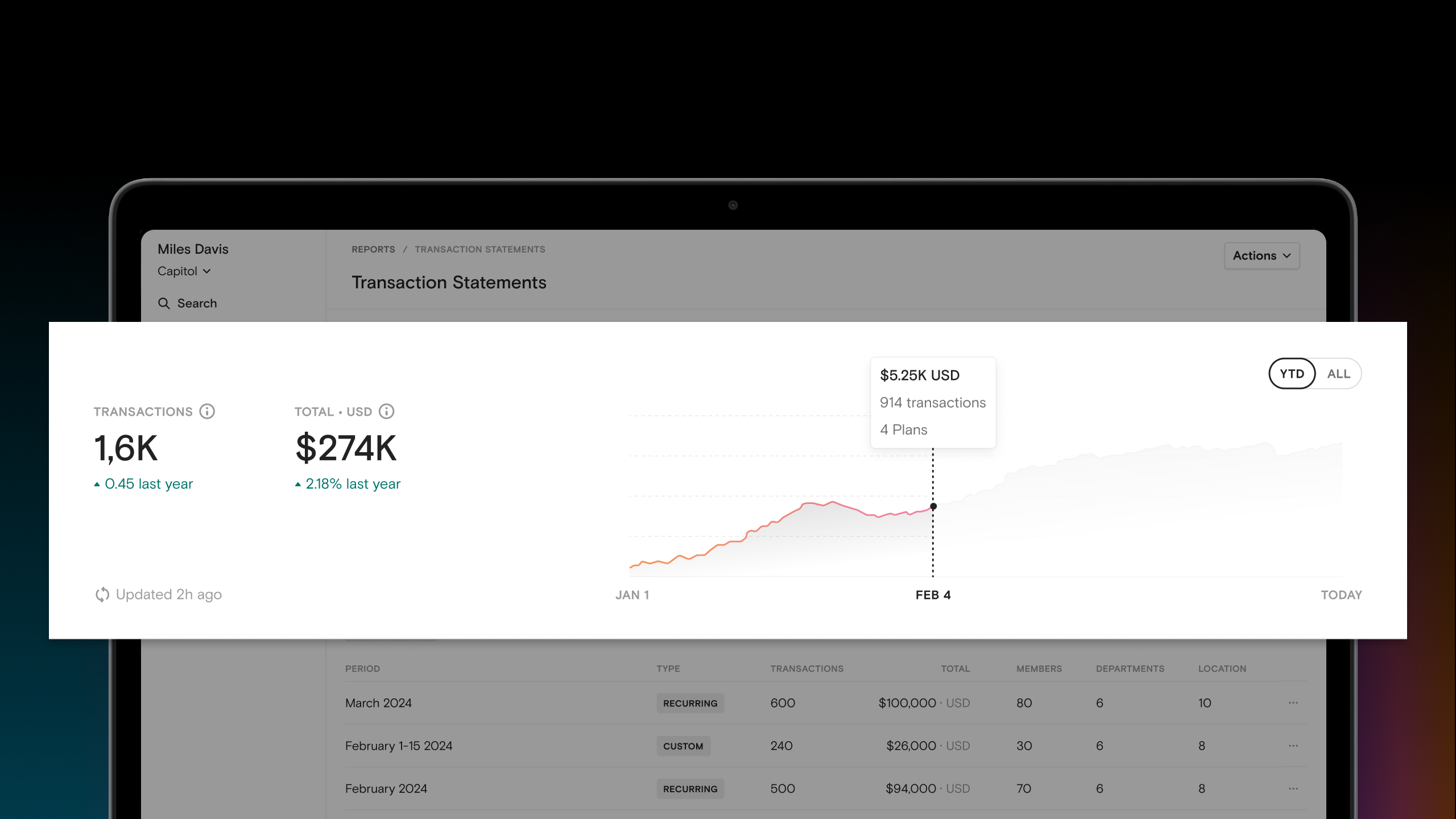

- Integrated dashboard: Level provides a single dashboard that simplifies deployment and core integrations while making it easy to measure utilization and ROI across your benefits.

- Expert support: Level offers extensive ongoing support via dedicated success managers, meaning we’re on hand when you need us for anything from compliance expertise to documentation and communications.

Join the waiting list

We’re partnering with employers and consultants to deliver a more rewarding benefits experience for their people. Together, we’re building towards a fully-automated future where you don’t have to be an expert to maximize your benefits.

Interested in a more intelligent approach to benefits? For more details about Level Pre-Tax, visit level.com/pre-tax or contact us to learn more about early access.

About Level

Level’s mission is to create greater access to benefits to help everyone maximize their total compensation.

1 2023 Annual Healthcare Research: Visa, ECFC