Benchmark data to help build an LSA

Lessons from a juicer

A friend of mine was recently gifted a juicer. She raves about juicing apples, oranges, carrots, celery, kale, anything! If a fruit or veggie has juice inside it, she’ll extract and drink it. She beams about the health benefits: she has more energy, has less desire to eat junk food, gets sick less often, etc., etc. I was sold, I needed one. So how, in 2023, does one purchase a juicer? Do I walk into the nearest health food store and purchase what’s on the shelf? No, no, no, that’s no good. In 2023 we have INFORMATION! We have DATA! How could I possibly purchase a juicer without first getting as much data as possible on the thriving and robust juicer machine market? So I dove into the Google search bar and after a few short clicks I was eyes deep in juicer data from pitcher capacity to wattage, from mastication rates to pulp dryness.

When you are building an employee benefits package you also need data. Sure, I could have just purchased the juicer my friend has, but I want the best juicer for me. When you are building a Lifestyle Spending Account (LSA) you want a good lay of the land to know what will work best for your team. Each company has their own unique culture and style and, as discussed in our previous blog post, LSAs are an amazing tool to enhance your benefits package in a way that aligns with your company culture.

In case you couldn’t have guessed, I work on the Data team at Level. LSA and other benefits data is what my team live in every day. In this post I’m excited to delve into the steps you’ll take to build an LSA and to bring you numbers to help make those decisions.

Start with benchmarking

So where to start? If you are looking for a new vendor for your more traditional benefits (medical, dental, 401K) you likely already have a similar offering today that you are replacing. This gives you a baseline to start from. For many employers, however, LSAs are not in their current benefit suite so it can be more difficult to know how much or how often to offer the funds, who should be eligible and what will be covered. So let’s start with that data. In no way are we suggesting you need to ‘follow the crowd’, but, it’s nice to know what the crowd is doing so you can calibrate from there.

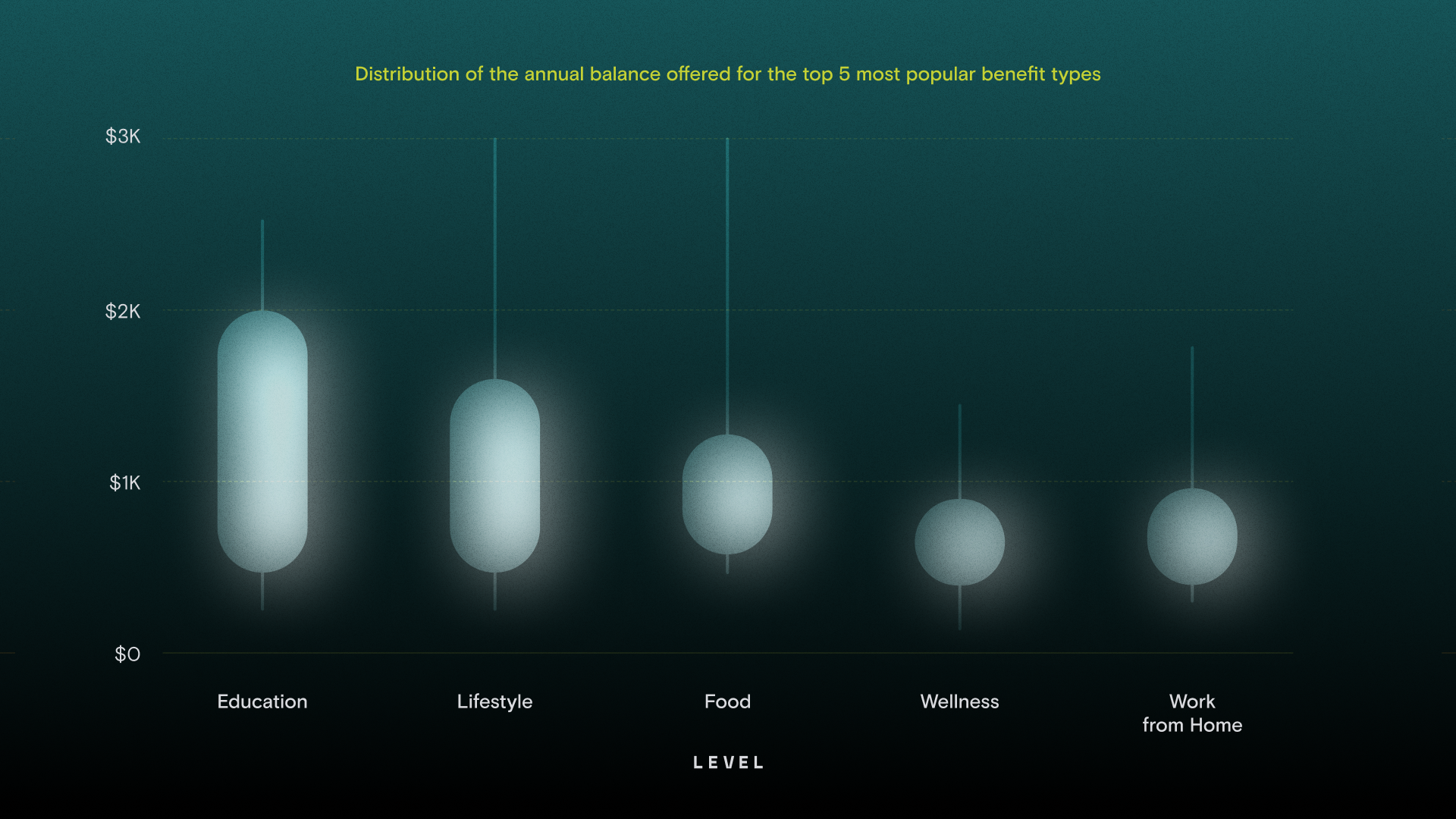

Let’s start with how much is being offered by benefit type. The chart below shows a distribution of the annual balance offered for the top 5 most popular benefit types offered on Level’s platform. The white ovals show the middle 50% range of offerings and the tails are the top and bottom 25% in terms of benefit amount.

For example, the oval for Education begins at $500. So if you offered $500 annually in an education fund, that benefit would be richer than 25% of the employers we see offering this fund. If you offered $2,000 (the other end of the oval) it would be richer than 75% of employers.

As you can see, there are some pretty clear trends, i.e., annual Wellness benefits are usually offered in the $500-$1,000 range. Work from home, also typically just under $1,000. But in reality, there is no one-size-fits-all. Several employers are thinking out of the box and offering $3,000 and more annually in Lifestyle or Food funds - and the employees will easily use them up! The point is, depending on your own company culture and where you want to sit on the spectrum of benefit offerings, knowing today’s benchmarks allows you to decide a good annual benefit amount.

When can employees use the benefit?

Another question you will need to answer when building an LSA is the cadence of the benefit offering. Will the benefit be a one time thing? A lump sum available for the full year, or provided monthly or quarterly? To decide, you will need to take into account how this affects cash flow, how often the benefit will be utilized and how much of the benefit dollars will be spent (more on the last further down). Again, looking at the top 5 benefits that Level offers, the charts below provide some insight on what employers are doing today.

Lifestyle and Wellness are a bit of a mixed bag, mostly a monthly cadence but also seeing other refresh rates. Not entirely surprising that Education funds are usually annual. We also see a good variety in the Work From Home (WFH) benefit, but this is mostly related to the tax treatment of these funds. WFH benefits can be administered as either a taxable LSA or a tax advantaged business spending account, depending on the employer’s preference. If you want to cover the cost of employees buying a desk, monitor or chair (which they likely only need to purchase once), that comes in the form of a one time, tax advantaged fund. The monthly and quarterly WFH funds shown in this chart typically cover other home office expenses as well such as cell phone or internet bills.

Food is an interesting benefit to offer as an LSA. It is almost always offered as a monthly benefit and employees always spend it all. Everyone likes to go out to eat on the company dime, right? We’re seeing employers offer this benefit almost as a simple reminder that you are appreciated, we want you to remember that often. A great reason to offer monthly benefits.

Note that the data shown here is for a fairly wide range of employer sizes and industries, to discuss benchmarks that are more specific to your team’s size and industry, reach out to us.

Employee usage

To wrap up our journey in peering into LSA data, we will ask the question, “Will employees use the benefit?” Let’s take a look. How much a benefit is utilized will affect employees’ perception of the benefit and by extension, perception of their employer. Usage is measured in two ways: how many employees access the benefit (employee engagement) and how much of the available balance is spent (utilization). Both are important metrics to understand and monitor. High engagement indicates employees know about the benefit and understand how to use it. High utilization indicates they love the benefit and want more!

How much the employees use the benefit will also affect the cost to you, the employer. If you offer a $100 monthly Wellness fund to your 500 employees, should you budget $50,000 a month? Possibly. Level makes using your LSA funds extremely easy which results in a high level of engagement and utilization, however, the employer only pays what the employees actually use.

Level processed transactions of all shapes and sizes in 2022, from a variety of LSA types from Food to Education, from Wellness to Family Planning benefits. There are many factors that will contribute to whether and how much employees will use their lifestyle spending account funds, including: balance amount, refresh rate, plan coverage and employee communications. For a Lifestyle spending account that has broad coverage, Level plans typically see 90%+ engagement and 80%+ utilization. On a fund that is targeted for Wellness, we may see 70%-80% engagement with about 50%-60% of total funds spent.

To offer a few thousand data points on this - here is 12 months of member utilization for a Level Lifestyle Spending Account client. The horizontal axis represents what percent of the total funds available were spent and the vertical axis is how many distinct purchases were made. What’s great about this chart is it shows the tremendous variety in usage. Level’s lifestyle spending accounts give your employees true freedom in how to spend the dollars. You can see that many, in the bottom right corner, made just a few large purchases to use up all their funds, perhaps in electronic devices or vacations. While many other members decided to buy lots of smaller purchases, maybe daily morning coffees or several monthly app subscriptions. In fact, in just the first three months of 2023, this particular clients’ members made purchases from over 10,000 different merchants.

Just enough data to get started

There are many factors that come into play when deciding which LSA to set up and how it will look. And whether you’re shopping for a centrifugal or cold press juicer OR setting up a brand new Wellness fund, you want to have relevant data available to help make that decision. The LSA that you implement can be a significant boost to morale and culture when designed correctly. In this post we’ve really just lightly touched on the data needed to design the right plan for your employees.

Are you interested in maximizing the impact of benefits by leveraging data? Would your employees find value in benefits like wellness, education, mental health, WFH stipends, and more? Reach out to us here to learn about how Level LSAs and our obsession with data can bring meaningful impact to your employees and organization.